Peloton Interactive (PTON) provides fitness equipment and content. It plans to report its fiscal Q4 2022 results on August 25. The upcoming Peloton earnings are for the three months ended June 30. The TipRanks website traffic tool hints at downbeat results.

Peloton’s Website Traffic Declines

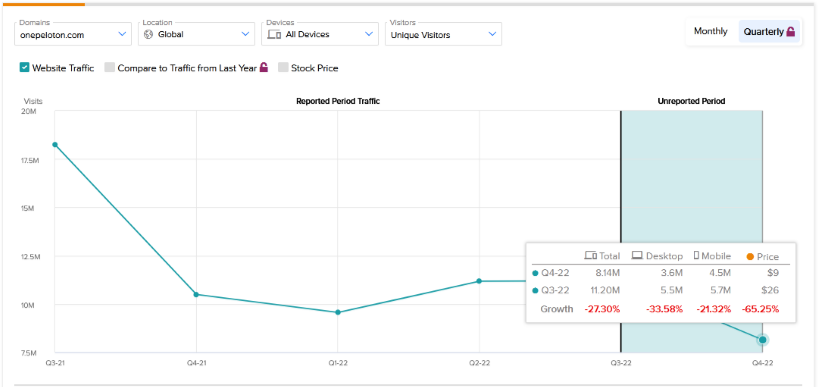

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Peloton’s performance this quarter.

The tool shows that the Peloton website recorded a 27.3% drop in global visits in Q4 compared to Q3. Moreover, the Peloton website traffic has declined 30.8% year-to-date.

The TipRanks Website Traffic Tool provides a gauge of customer interest in a company’s products. An upward website traffic trend can indicate increased demand for the products, which can in turn hint at strong earnings. Conversely, a downward website traffic trend can indicate weak demand and point to downbeat earnings.

Learn how Website Traffic can help you research your favorite stocks.

What Is Wall Street Saying About Peloton’s Q4 Earnings?

Analysts, on average, expect Peloton to report a loss per share of $0.77 on revenue of $682.93 million. Peloton’s internal estimates call for revenue in the range of $675 million to $700 million. The company did not issue EPS guidance. In the year-ago quarter, Peloton reported a loss per share of $1.05 on revenue of $936.9 million.

Peloton’s business boomed at the height of the COVID-19 pandemic as people turned to indoor exercise amid the lockdowns. The relaxing of pandemic restrictions has adversely impacted demand for the company’s products as people return to the gym. Peloton is switching from operating its own factories to contract manufacturing in response to the evolving market conditions.

Is PTON a Buy or Sell?

Peloton’s stock has dropped about 67% year-to-date. Wall Street is cautiously bullish on the stock. According to TipRanks’ analyst rating consensus, PTON stock is a Moderate Buy based on five Buys and six Holds. The average PTON stock forecast of $18 implies 54% upside potential.

Peloton remains a favorite of elite investors despite its steep decline. TipRanks’ Hedge Fund Trading Activity tool shows that confidence in PTON is currently Very Positive. Some 11 hedge funds increased their cumulative holdings of the stock by 1.8 million shares in the last quarter.

Final Thought

While Peloton’s website traffic trends suggest weak Q4 results, the company’s ongoing adjustments in response to market conditions may pay off down the road. For example, exiting in-house manufacturing may help Peloton improve its profit margins over time by removing some fixed factory costs.

Read full Disclosure

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog